Navigating the EB5 Visa Process: A Detailed Guide for UK People

The EB5 Visa procedure provides a pathway to united state residency for UK residents via investment. Comprehending the actions entailed is crucial for an effective application. From identifying the right financial investment option to guiding through the intricacies of paperwork, each stage has its obstacles. As people begin this trip, they must understand the qualification demands and the possible obstacles that might occur. What approaches can ensure a smoother transition right into this procedure?

Recognizing the EB5 Visa Program

What makes the EB5 Visa Program an attractive choice for financiers? This program uses a pathway to united state irreversible residency through investment in job-creating business. By spending a minimum of $900,000 in targeted work areas or $1.8 million in other areas, international capitalists can protect a copyright for themselves and their prompt family members. The EB5 Visa is appealing because of its double benefits: prospective roi and the opportunity for a stable life in the United States. In addition, the program allows financiers to get involved in a thriving economic climate and add to work production, enhancing their charm as liable worldwide residents. The possibility of a streamlined migration procedure even more solidifies the program's beauty, making it an engaging choice for numerous.

Qualification Requirements for UK Citizens

To get the EB5 visa, UK residents must fulfill particular investment quantity criteria, usually needing a minimum investment in an U.S. business. Additionally, applicants need to show the lawful source of their funds to ensure conformity with migration laws. Understanding these demands is crucial for a successful application procedure.

Financial Investment Quantity Criteria

Understanding the financial investment quantity standards is vital for UK citizens looking for to take part in the EB5 visa program. The minimal investment required generally stands at $1 million in a brand-new company. This amount is minimized to $500,000 if the financial investment is made in a targeted employment location (TEA), which is defined by high unemployment or reduced population thickness. This distinction is important, as it offers a possibility for financiers to add to financially distressed areas while likewise fulfilling visa needs. It is crucial for prospective capitalists to be knowledgeable about these economic thresholds, as they straight affect qualification and the overall success of their EB5 application procedure. Cautious factor to consider of the financial investment amount can considerably influence the outcome.

Source of Funds

Developing the source of funds is an important facet of the EB5 visa procedure for UK citizens. Candidates should give detailed documentation that demonstrates the lawful beginning of their investment resources. This involves in-depth monetary records, consisting of bank statements, income tax return, and evidence of revenue. It is crucial to trace the funds back to their original resource, whether originated from service profits, investments, or individual cost savings. The United State Citizenship and Migration Solutions (USCIS) scrutinizes these files to confirm that the funds were not obtained via unlawful methods. As a result, UK citizens need to be prepared to offer a clear and clear economic background, assuring conformity with the EB5 program's qualification requirements. Correct preparation can considerably improve the opportunities of an effective application.

Financial Investment Options: Straight vs. Regional Center

Steering through the investment landscape of the EB5 visa program reveals 2 main alternatives for UK citizens: straight financial investments and local facility tasks. Straight investments entail investing in a brand-new industrial business, where the capitalist commonly takes an energetic duty in the service operations - EB5 Visa. This route may provide higher returns but calls for extra hands-on monitoring and a complete understanding of the organization landscape

On the other hand, local facility jobs permit investors to add to pre-approved entities that handle multiple EB5 financial investments. This option usually requires less participation from the capitalist and can supply an extra easy investment experience. Both opportunities have unique benefits and difficulties, demanding mindful consideration based on private monetary objectives and take the chance of resistance.

The Minimum Financial Investment Quantity

The EB5 visa process calls for a minimum financial investment quantity that varies depending on the picked investment course. For those opting for a Regional Center, the basic financial investment threshold is typically greater as a result of the nature of these projects. Understanding these economic requirements is crucial for UK residents seeking to browse the EB5 program properly.

Investment Quantity Review

Recognizing the monetary demands of the EB5 visa process is essential for UK residents considering this migration pathway. The EB5 visa program normally mandates a minimal investment quantity of $1 million in a brand-new business. However, this amount can be reduced to $500,000 if the investment is made in a targeted work area (TEA), which is identified by high unemployment or rural area. These financial investment thresholds are necessary for getting the visa, as they directly affect the qualification of candidates. Potential investors must meticulously examine their monetary capabilities and warranty conformity with the established requirements. This investment not only opens up the door to U.S. residency yet likewise contributes to financial growth and work creation within the nation.

Regional Center Choice

While discovering the EB5 visa choices, investors may discover the Regional Center program especially appealing due to its reduced minimum financial investment need - EB5 For British Investors. Since October 2023, the minimal financial investment amount for the Regional Center choice is established at $800,000, substantially less than the $1,050,000 needed for direct financial investments in brand-new business. This decreased threshold permits extra financiers to participate, especially those seeking a much more passive financial investment method. The Regional Facility program additionally offers the advantage of work development via click for more info pooled financial investments in larger jobs, which can bring about a smoother course to permanent residency. As a result, for UK citizens taking into consideration the EB5 visa, the Regional Center option uses a compelling monetary motivation alongside potential development opportunities

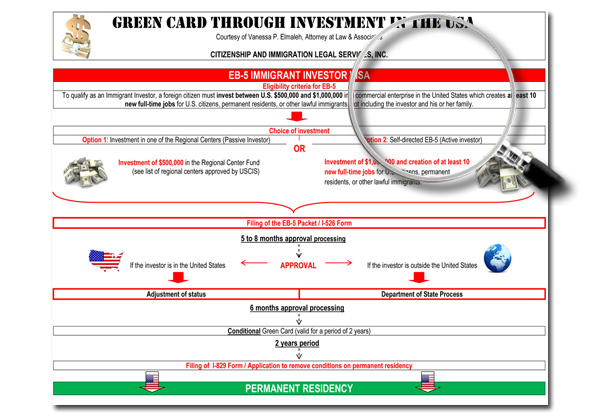

The Application Process: Step-by-Step

Steering the EB5 visa process needs careful interest to detail, as each action is vital for success. Initially, applicants should choose either a straight financial investment or a local center option, relying on their investment method. Next, they have to gather required documentation, consisting of proof of funds and a substantial service plan. Once prepared, applicants send Kind I-526, the Immigrant Request by Alien Investor, to the United States Citizenship and Migration Solutions (USCIS) After approval, applicants can request a visa at a united state consular office or change their status if currently in the U.S. Upon arrival, financiers must keep their investment for a designated period, generally two years, to meet the EB5 demands.

Typical Difficulties and Exactly How to Overcome Them

The EB5 visa procedure offers several difficulties that applicants have to browse successfully. One usual hurdle is comprehending the complex legal needs, which can cause delays and false impressions. To overcome this, applicants need to seek aid from knowledgeable immigration attorneys accustomed to EB5 policies. An additional difficulty is safeguarding the required investment funds, as sourcing capital can be challenging. Possible capitalists ought to prepare comprehensive financial documents and consider collaborating with economic consultants to guarantee conformity with the demands. In addition, prolonged handling times can develop anxiety; applicants can alleviate this by remaining arranged and positive in communication with the USA Citizenship and Migration Provider (USCIS) Diligence and informed preparation are vital for a smoother EB5 application experience.

Keeping Your EB5 Condition and Path to Citizenship

Effectively keeping EB5 condition is essential for financiers aiming to attain irreversible residency in the United States. To preserve this condition, financiers must ensure that their capital expense stays at risk and that the investment produces the required variety of jobs within the stipulated timeframe. Normal communication with the regional facility or project managers is essential to stay notified concerning conformity and efficiency metrics.

Financiers have to submit Form I-829, the Petition by Business Owner to Remove Conditions, within the 90-day window prior to the two-year anniversary of getting conditional residency. This application calls for paperwork demonstrating that all investment problems have actually been met. Lastly, preserving a clean legal record and adhering to U (EB5 Visa For UK Citizens).S. regulations will markedly enhance the course to ultimate citizenship

Regularly Asked Concerns

How much time Does the EB5 Visa Process Commonly Take?

The EB5 visa procedure commonly takes about 12 to 24 months. Aspects such as refining times at United state Citizenship and Immigration Solutions and the volume of applications can trigger variations in this duration.

Can Family Members Join Me on My EB5 Visa?

Yes, member of the family can go along with a private on an EB5 visa. This includes partners and youngsters under 21, permitting them to get long-term residency alongside the primary candidate throughout the visa procedure.

What Happens if My Financial Investment Falls short?

If the financial investment falls short, the individual may lose the spent funding and possibly jeopardize their visa standing. They need to consult with an immigration attorney to explore alternatives for preserving residency or dealing with the financial investment loss.

Exist Age Restrictions for Dependents Using With Me?

There are age limitations for dependents using with the primary candidate. Only single kids under 21 years of ages can certify as dependents, implying those over this age should apply individually for their very own visas.

Can I Function in the U.S. With an EB5 Visa?

An individual holding an EB-5 visa is allowed to work in the USA. This visa grants them the capacity to participate in employment possibility, as it results in irreversible residency status upon meeting the demands.